CoinEx Research June 2025 Report: Bitcoin in the Crossfire

HONG KONG, July 03, 2025 (GLOBE NEWSWIRE) -- CoinEx Research’s June 2025 Report: June was a month of volatility and resilience for Bitcoin, which dipped due to heightened Middle East tensions but rebounded by month-end on easing geopolitical risk. Meanwhile, Circle’s landmark IPO signaled rising confidence in crypto's capital market maturity. Real-World Assets (RWA) continued their sharp climb, supported by regulatory breakthroughs in the U.S., Europe, and Asia. Stablecoin issuance rebounded to $5 billion, preserving the market’s bullish foundation despite macro headwinds. Together, these events point to a digital asset landscape that’s evolving quickly from speculation toward institutional-scale adoption.

Market Overview: Bitcoin Dips Below $100K

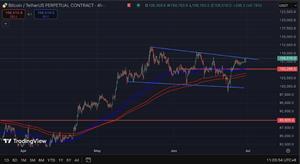

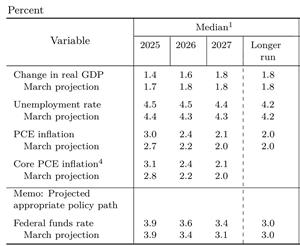

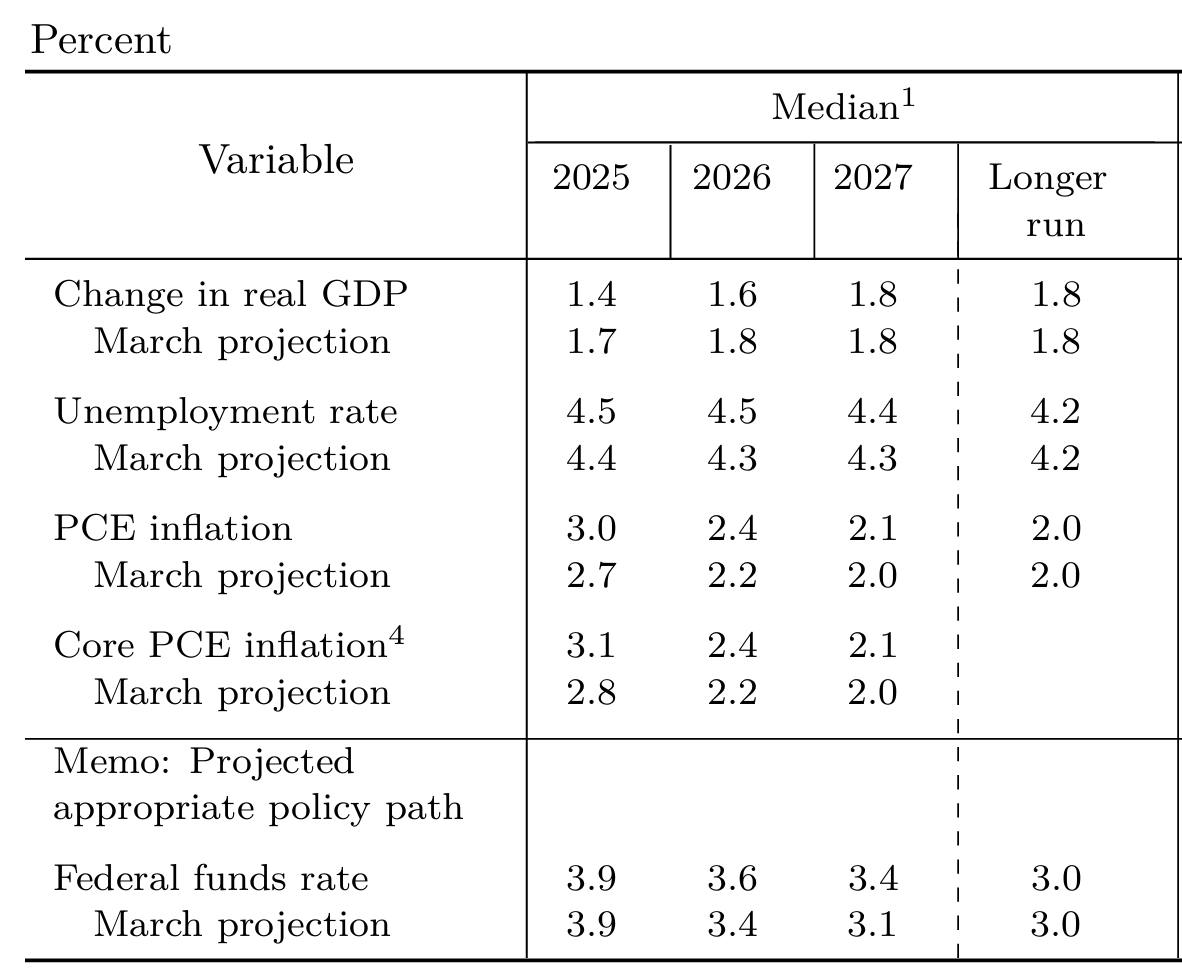

Bitcoin started June near $105,000 but dropped to $98,200 after a U.S. airstrike on Iranian nuclear sites, reflecting heightened sensitivity to geopolitical risk. The decline reversed after a June 24 ceasefire between Israel and Iran, with BTC rebounding toward $108,000 by month-end. Meanwhile, the Fed held rates steady, signaling potential cuts later in 2025. However, persistent inflation, new China tariffs, and looming trade tensions kept markets cautious but resilient.

Source: Federal Reserve Board; Data as of 18 June 2025

Bitcoin Dominance Holds Firm

Bitcoin experienced a deep correction due to geopolitical events but returned to the upper edge of its high-level trading range. It now stands at a critical inflection point, with the market awaiting confirmation of either a breakout or a rejection and subsequent retest near the red support level around $105,000.

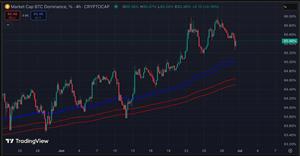

BTC Dominance maintained an upward trend throughout June, with no signs of weakening. The return of altseason still appears to be a distant prospect.

Circle’s IPO Crypto's Public Market Entry

In a milestone for crypto’s crossover into traditional finance, Circle went public in June with a successful IPOs. Priced at $31, well above its initial guidance range of $27–$28. Circle raised $1.05 billion. On its debut day, the stock opened at $69, peaked at $103.75, and closed at $83.23, giving the company a $18.4 billion valuation.By month-end, the stock surged to $180, lifting Circle’s market cap to $40 billion.

This stellar debut positions Circle as an example. Companies such as Kraken, Gemini, Bullish, BitGo, Consensys, and Chainalysis are seen as potential candidates for future listings.

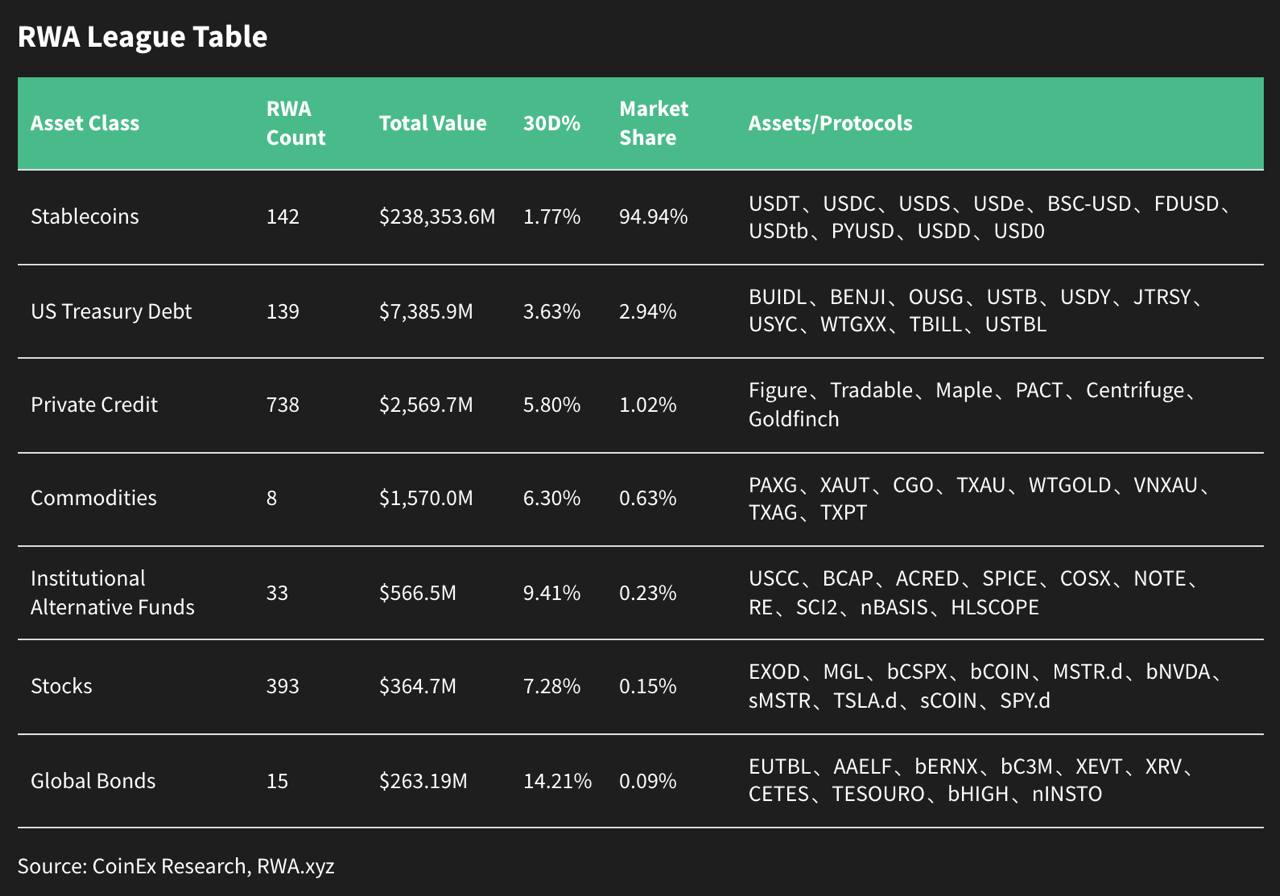

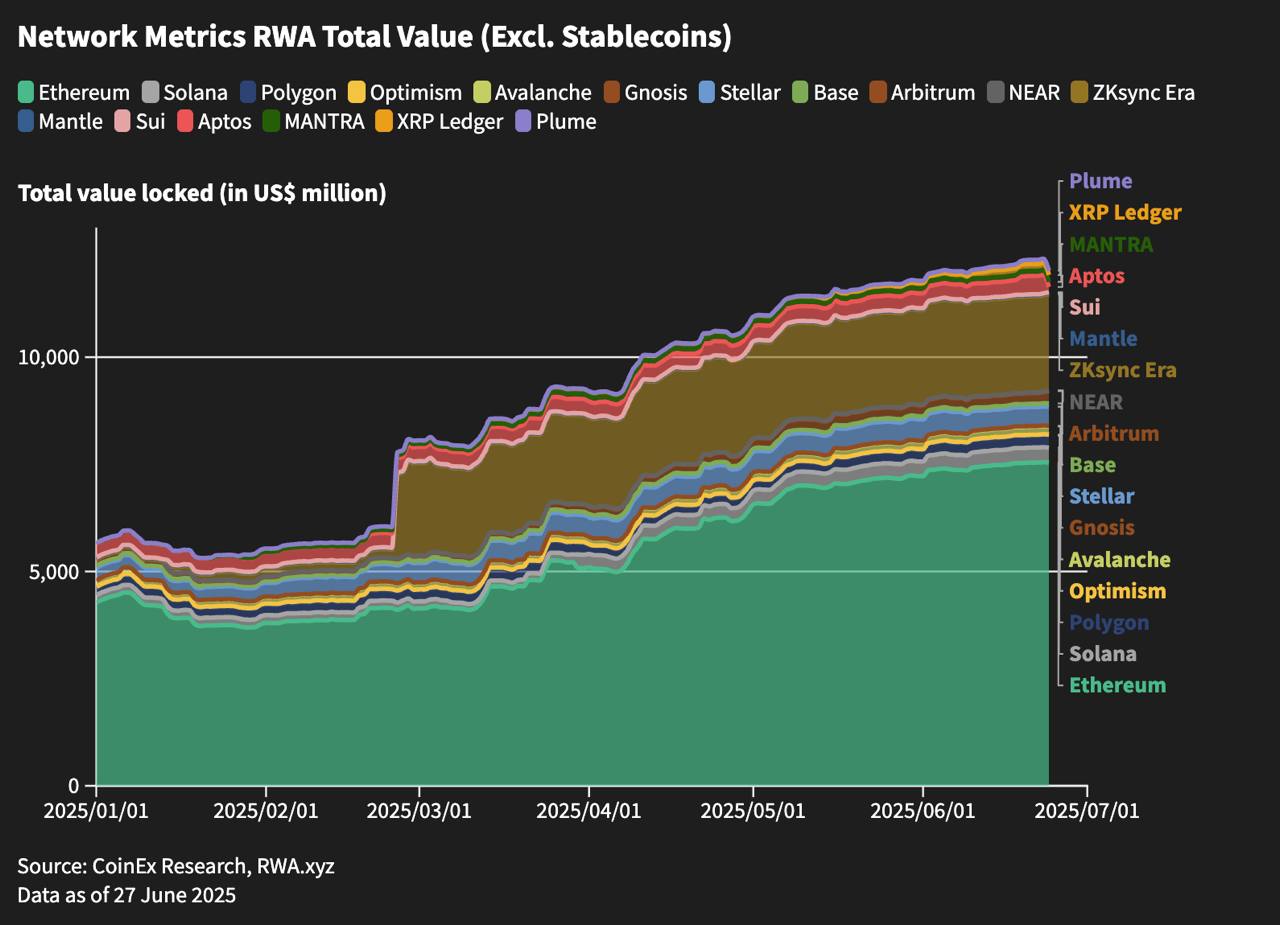

RWA Explosive Growth

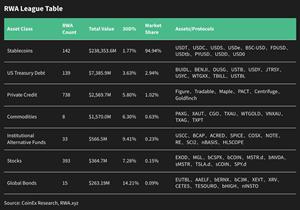

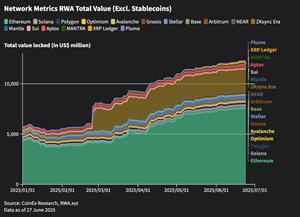

Real-World Assets (RWAs) solidified their position as one of the fastest-growing sectors in crypto. Excluding stablecoins, the on-chain RWA market cap soared past $23 billion, marking an 85%+ year-to-date gain. When stablecoins are included, the tokenized real-world asset market exceeds $200 billion in size.

Ethereum continues to dominate the RWA space, holding a 59% market share. Among the standout performers is BlackRock’s BUIDL fund, which has grown to $2.7 billion in assets, becoming a critical engine behind RWA total value locked (TVL).

The surge in RWAs is backed by decisive regulatory momentum. In the U.S., the Senate passed the GENIUS Act, which provides regulatory clarity for dollar-backed stablecoins and RWA instruments. In Europe, MiCA (Markets in Crypto-Assets) regulations went into full effect in December 2024. Asia followed, with Hong Kong and Singapore launching sandbox environments designed to test and scale tokenization infrastructure.

Global Regulation: Stablecoins and Tokenized Assets

On June 17, 2025, the U.S. Senate passed the GENIUS Act with strong bipartisan support (68–30), moving the legislation forward to the House of Representatives for further deliberation. The GENIUS Act seeks to advance innovation in dollar-backed stablecoins.

At the global level, the stablecoin landscape is evolving quickly under a wave of regulatory clarity and compliance reform. The European Union led the way by fully implementing its Markets in Crypto-Assets (MiCA) framework on December 30, 2024. In parallel, Hong Kong introduced its own regulatory regime for stablecoins on May 21, 2025, aligning local policy with international standards.

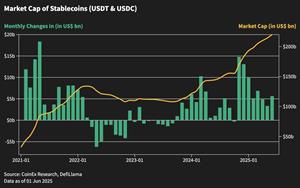

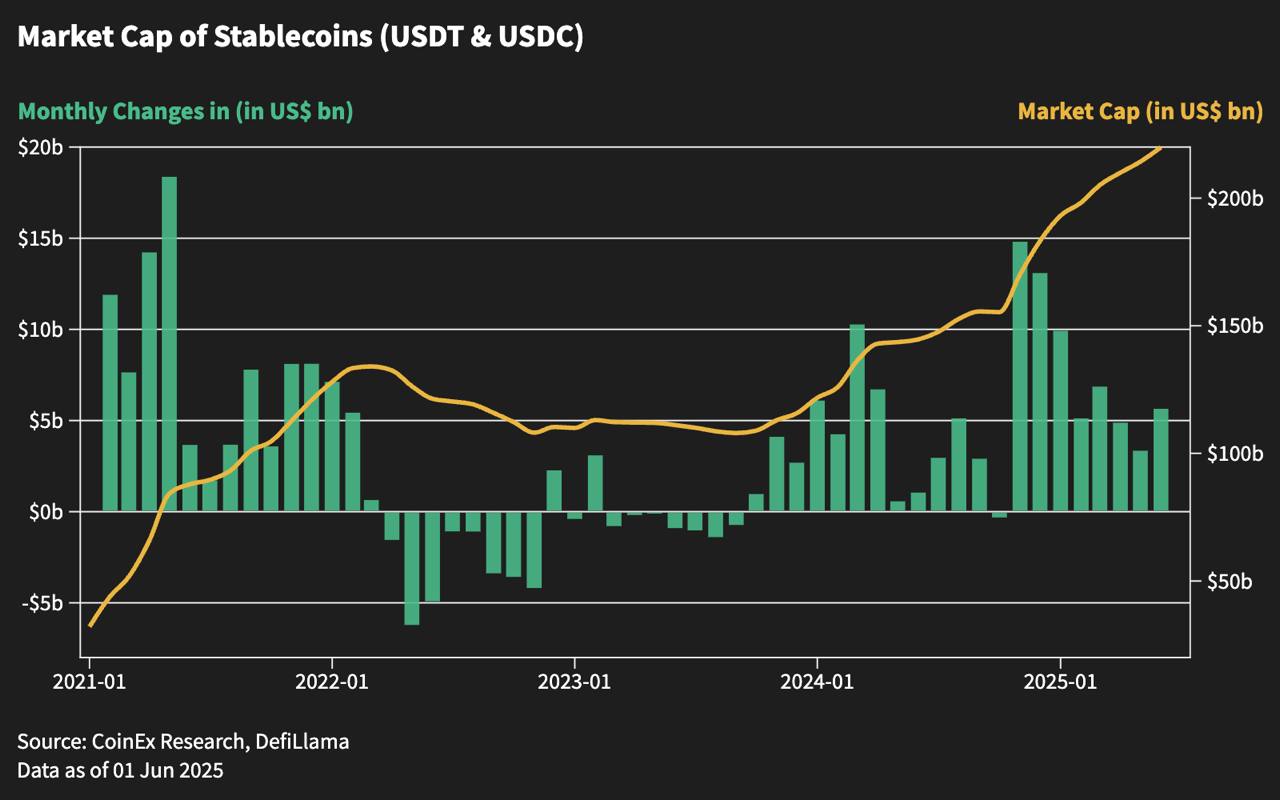

Stablecoin Inflows Rebound, But Utility Shifts Beyond Trading

Stablecoin issuance rebounded in June after several months of stagnation, rising to $5 billion. This reversal preserved the structural integrity of the current bull cycle, ensuring continued liquidity and capital depth within crypto markets.

However, the role of stablecoins may be evolving from trading and speculation toward payments. CoinEx Research suggests ongoing monitoring is needed to refine interpretation of stablecoin metrics in the current cycle.

Looking Ahead: Macro Risk, Rate Cuts, and Strategic Rotation

As July 2025 begins, crypto markets face a mix of opportunity and risk. While the Iran-Israel ceasefire has eased geopolitical tensions, inflation, tariffs, and macro uncertainty persist. Bitcoin remains technically strong near its range high, but a failed breakout could retest $105,000. With BTC dominance holding firm, an altseason appears unlikely for now.

Institutional momentum—from rising ETF flows to Circle’s IPO—reflects growing confidence in foundational crypto infrastructure. At the same time, the rapid rise of RWAs and global regulatory milestones like the GENIUS Act, MiCA, and Asia’s sandbox initiatives signal a shift toward a more mature, policy-aligned market. July may prove pivotal as capital rotates toward utility, compliance, and real-world use cases.

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

pr@coinex.com

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/168f497d-c0d2-4cce-ab22-c9ef99cfb4b2

https://www.globenewswire.com/NewsRoom/AttachmentNg/e57475b6-3541-4d3c-805e-73e656fc5fc4

https://www.globenewswire.com/NewsRoom/AttachmentNg/1221fa94-2e13-405f-9bae-afd20480f5a9

https://www.globenewswire.com/NewsRoom/AttachmentNg/59b3a6ab-2835-4caf-9437-aa3f1a320aad

https://www.globenewswire.com/NewsRoom/AttachmentNg/02bab3f5-e31d-423f-bd04-65679c6a55c9

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc93e417-b1ce-4236-84a2-1fae984196c5

https://www.globenewswire.com/NewsRoom/AttachmentNg/8dd7116a-25c1-4b13-8fd8-57605ed669f1

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.